In virtually all areas of life, 2020 will be remembered as a year like no other. Activity in the courts across Ireland, provides an interesting snapshot on society and the economy, in any given year. In that context, the 2020 Courts Service Annual Report, published in July 2021, describes an unprecedented year indeed.

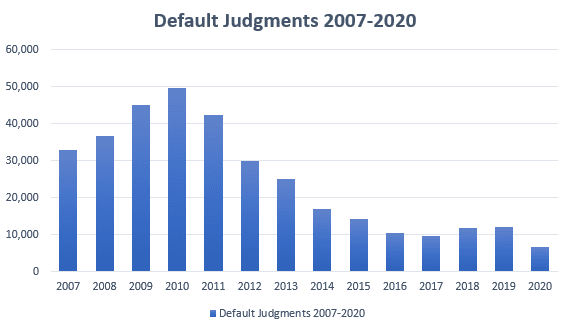

In our previous reviews of Courts Service Annual Reports from 2019 and 2018 we noted that certain trends in recovery litigation and enforcement showed a revival in the wider Irish economy. For example, the numbers for monetary judgments obtained against debtors in default of appearance or defence had fallen from almost 50,000 in 2021 to just 12,182 in 2019. The trend had reached its lowest point in 2017, but in recent years, creditor activity in the District Court begun to push it upward. However, only 6,617 judgments were obtained by creditors in 2020 – half of the 2019 figure. The drop-off was most dramatic at High Court levels, where there were just 58 default judgments in 2020, compared to the 552 in 2019.

This trend of a huge decrease in creditor activity, can be seen in the 2020 Report by an examination of the numbers of remedies that judgment creditors might normally seek to avail of. For example:

-

In 2020, there were 1,240 new Instalment Order cases commenced, compared to almost 2,000 in 2019

-

2020 saw some 875 Judgment Mortgage Affidavits certified as opposed to 2,180 in 2019

Possession Litigation

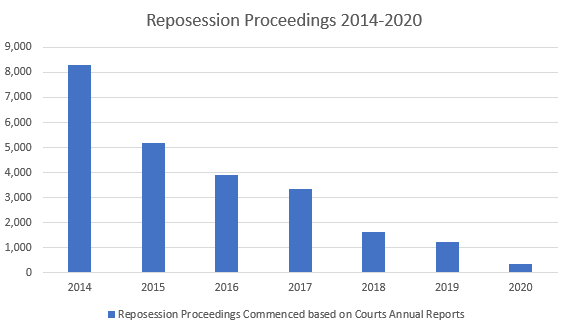

When the figures for proceedings taken by lenders for orders to repossess secured properties, on foot of the lender’s power in a mortgage or charge document are examined, the year-on-year decline is even more pronounced. In 2020, there were just 327 of these cases commenced across both High and Circuit Courts. This is less than a quarter of those in 2019. As noted by the Chief Justice at the launch of the 2020 Report, this translated into a 96% reduction in new possession cases since 2014. However, that does not mean that the underlying mortgage arrears issues have vanished.

Personal Insolvency

The falloff in personal insolvency activity was not quite so dramatic. This stands to reason as it’s a sphere of debt collection activity that is debtor, rather than creditor, driven. The requests for insolvency arrangements in the High Court fell by about 50% and by about 25% in the Circuit Court in 2020. Debtors self-petitioning for their bankruptcy also dropped by approximately 50% from 2019 to 2020. Bankruptcy by creditors was also down 75% when compared to 2019.

What drove these dramatic reductions?

In tandem with the public health restrictions introduced in response to the COVID-19 pandemic, certain State supports and interventions had a dramatic effect on court activity last year. For example:

-

The temporary ban on evictions and rent increases introduced in March 2020 certainly contributed to large reductions in property and breach of contract litigation.

-

One of the key arms of the State in a debt collection context is of course the Revenue Commissioners. In March 2020, Revenue announced a comprehensive suspension on debt enforcement activity. Revenue also offered to warehouse eligible debt associated with the COVID-19 pandemic.

-

Temporary payment breaks on business loans and mortgage repayment obligations were announced in March 2020 by financial institutions. The payment breaks were accompanied by a formal moratorium upon residential repossession actions, which certainly led to the dramatic increase in possession activity. In practice, financial institutions also exercised a large degree of forbearance on legal action against debtors. This includes those who may not have strictly qualified for payment breaks or fallen under the repossession activity moratorium.

-

Finally, it should be acknowledged that the public health restrictions introduced to prevent the spread of COVID-19, particularly the requirement for social distancing, meant that most in-person court hearings could not take place. The resources of the Courts Service were directed to ensuring that urgent matters like domestic violence, criminal prosecutions, and injunctions, were given priority for in-person hearings. Remote hearings became the norm in 2020 for certain types of cases and worked particularly well for cases where witness evidence was not required.

Comment

The unprecedented disruption and uncertainty caused by the COVID-19 pandemic and the public health restrictions introduced in response, mean that 2020 stands in stark contrast to previous years. As the Chief Justice noted at the Report’s launch, the pandemic has led to significant backlogs in areas of court activity. This will have to be worked through as we (hopefully) move to the end of the social and economic havoc wrought by the pandemic. Some of the country’s underlying social and economic conditions, like legacy mortgage arrears, were masked rather than resolved in 2020.

Finally, we had commented on the investment in the Courts Service in the past and lessons learned from Ireland’s response to the events of 2020 will hopefully inform such investment for the better.

For more information, contact a member of our Debt Recovery team.

The content of this article is provided for information purposes only and does not constitute legal or other advice.