Some 12 months ago, following the publication of that year’s Courts Service Annual Report, we suggested that 2020 would be remembered as a year like none other. However, a year later, the publication of the Courts Service Annual Report for 2021 (Report) describes a year of legal activity, in a debt recovery context, that very closely mirrors 2020.

It is probably easy to forget that the rolling public health restrictions initially introduced in March 2020, in response to the COVID-19 pandemic, were also prevalent for much of 2021. Most of us were confined to a 5km distance from our homes, and then within our county only, up to mid May 2021. Widespread COVID-19 vaccinations only gained traction by June/July 2021. Accordingly, the social and economic disruption that the pandemic, and the ensuing public health restrictions, had led to in 2020, are also reflected in the 2021 figures and broader trends, highlighted in the Report. Indeed, in the collections context, our analysis of the 2020 and 2021 numbers eerily match each other, year on year.

Judgments and corresponding enforcement remedies

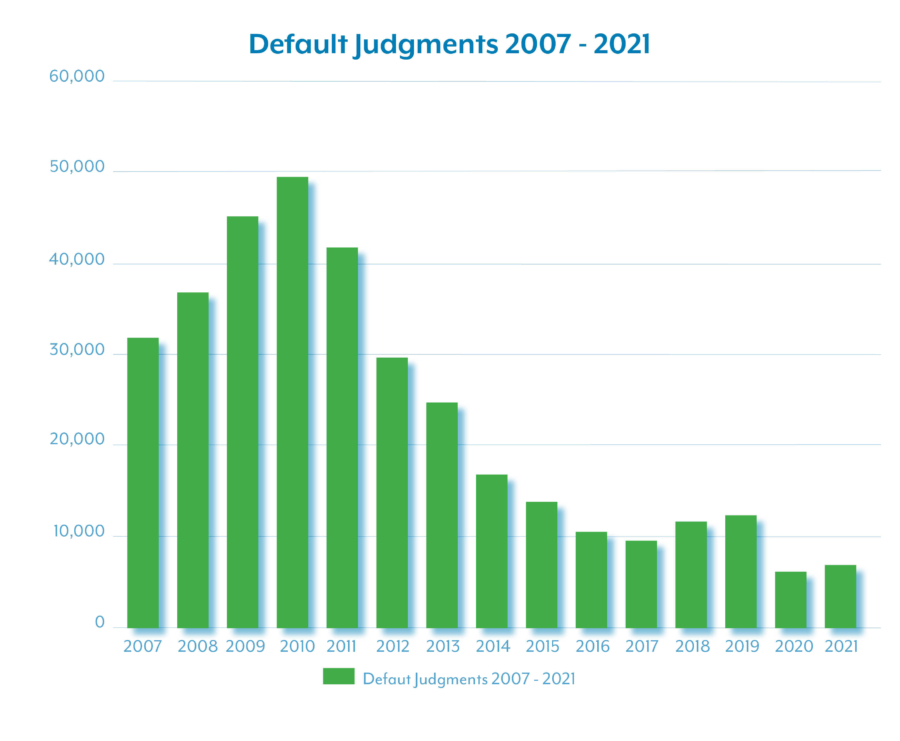

The number of monetary judgments obtained by creditors, in default of appearance or defence against debtors in 2021 (6,905) was extremely close to its 2020 equivalent. It is worth noting that this was about half of the same number that were obtained in 2019. Breaking the total down, whilst there was a small rise in District Court default judgments, the combined High and Circuit Court figure, was even down some 15% on the 2020 level. The return to levels of legal collection and enforcement activity seen in the years prior to 2020 were certainly not a factor in 2021.

This trend is also reflected across the figures set out in the Report for the usage of remedies that judgment creditors normally seek to avail of. These included:

- In 2021, creditors took steps to publish some 1,414 judgments in the Central Office of the High Court, mirroring the 1,408 in 2020

- 2021 saw the commencement of 1,243 new Installment Order cases, almost uncannily reflecting the 1,240 in 2020

- The volume of judgment mortgages registered, fell by 20% in 2021, compared to the previous year

Possession litigation

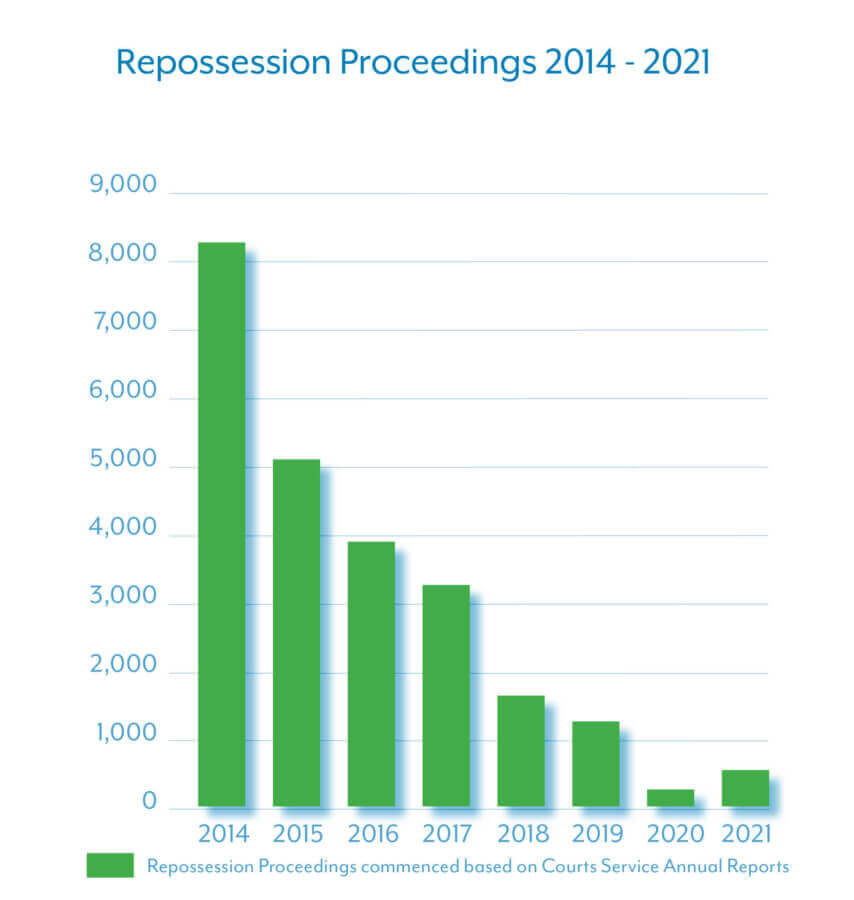

We had commented upon the underlying Irish mortgage arrears problem in analysis of previous annual reports. The figure for proceedings issued by lenders, to repossess secured properties, on foot of the lender’s rights in a mortgage/charge document, rose slightly in 2021, to 548, from 327. However, that figure was still just a quarter of its 2019 equivalent, with the formal moratorium on repossessions during 2020, spilling into an informal forbearance on such activity, in 2021.

Personal insolvency activity

The trends in personal insolvency proceedings in 2021 also mirrored the 2020 equivalent, certainly from the creditor’s viewpoint. This is illustrated bynumbers for creditor bankruptcy being just below those issued in 2020. Personal insolvency was a sphere of legal activity that proceeded, very successfully from a logistics perspective, in a remote setting. This was reflected in the 42% increase in the numbers of debtors petitioning for their own bankruptcy in 2021. The overall volume of arrangements applied for pursuant to the Personal Insolvency Act 2012 (as amended) remained similar to its 2020 equivalent, in 2021.

It’s interesting to note that the figures in the Report, for corporate insolvencies, be they examinerships, liquidations, direction restriction applications, etc., are almost identical. This is best illustrated by the fact that 75 applications to wind up companies, were received by the High Court in both 2020 and 2021.

Why did the figures remain so low?

In our analysis of the 2020 Courts Service Annual Report, we cited a number of reasons for this. It is interesting to note that the Report itself refers to the temporary payment breaks by financial institutions as being one of the key continuing reasons for the lack of collection and enforcement activity through the Courts, in 2021. The debt warehousing scheme offered by Revenue in 2020, continued into 2021, as did many government supports for businesses with such supports preventing or postponing bad debt events or insolvencies.

It is worth noting that whilst many court hearings moved successfully to a remote hearing basis, in 2020 and 2021, personal insolvency hearings being a good example, hearings in the debt recovery context where witness evidence was required were cancelled or postponed in those years.

Anecdotally, our own practice also suggests that deliberate creditor forbearance, in the context of the pandemic and the public health restrictions in 2021, was a key determinant in these numbers.

Comment

We have always suggested that there is a natural time lag, circa 1- 2 years, from a change in the country’s economic cycle being reflected in the collection litigation and enforcement figures in the Irish Courts. The lifting of almost all COVID-19 related public health restrictions in early 2022, and the ending of government financial supports, suggest that the artificially low debt litigation and enforcement figures witnessed in 2020 and 2021 will not continue. Indeed, it is worth noting one statistic in the Report, that for incoming actions in the High Court to recover debt which increased by 32%, belied the trend otherwise illustrated here.

Indeed, many commentators have suggested that the withdrawal of pandemic supports, supply chain disruption exacerbated by the war in Ukraine and soaring energy and fuel costs, will lead to a rise in bad debt and insolvencies in Ireland, just as it has in the UK. We would expect that the figures for insolvencies, collection litigation and enforcement will trend upwards for 2022 and believe that 2023 will see substantial increases.