CCPC blocks Dublin Airport’s purchase of disused car park

Following a voluntary notification and a lengthy Phase II investigation, the Competition and Consumer Protection Commission (CCPC) prohibited the proposed acquisition by DAA plc of a site near Dublin Airport (M23/011). The site, owned by property developer Gerard Gannon, had previously operated as a car park and appears to have been the only privately-owned site with the potential to serve Dublin Airport. The CCPC adopted a counterfactual, ie, the competitive situation absent the transaction, of the site being sold to an alternative purchaser who would operate it as a car park.

The CCPC had concerns that, by removing the most significant competitive threat to DAA, which would have a near monopoly, the acquisition would result in higher prices and reduced quality of service. Therefore, the CCPC found a Substantial Lessening of Competition, in the market for public car parking in the vicinity of Dublin Airport when compared to the counterfactual.

This decision marks only the second time in the last decade that the CCPC has prohibited a notified merger. The CCPC in 2022 prohibited Uniphar Plc’s proposed acquisition of pharmacy solutions business, NaviCorp Limited (M21/079).

CCPC preference for structural commitments persists

In Phey Topco / Trasmore (M/23/065), the CCPC reviewed the proposed acquisition of Dental Medical Ireland. The CCPC found that the purchaser would have had a share of approximately 50% of the full-line supply of dental consumables in the Republic of Ireland following the proposed 5-to-4 merger. Following an extended Phase I review, the CCPC cleared the transaction subject to the divestment of the purchaser’s Northern Irish subsidiary, BF Mullholland. These commitments eliminated entirely the overlap in the State. This transaction is a good example of how parties to a substantive transaction may avoid a protracted Phase II investigation by offering comprehensive remedies early in Phase I.

In LloydsPharmacy / McCabes Pharmacy (M/23/056), the CCPC unusually declared the notification invalid 65 working days into the review period after the parties failed to provide satisfactory responses to a request for information. The transaction was subsequently re-notified and cleared during Phase II (M/24/011) subject to structural commitments to divest two pharmacies.

These CCPC merger determinations reflect the CCPC’s continued preference for structural remedies. They also underline the CCPC’s position that parties are better off by proactively addressing substantive issues early in the process.

Consolidation in the vet sector

A trend of veterinary practice consolidation appears to be taking hold in Ireland. Five transactions were notified in the Irish veterinary sector by UK-based veterinary services providers in 2024. This mirrors, to some extent, a wave of consolidation in the UK vet sector where it is reported that approximately 30% of vet practices have been acquired by six large corporate groups since 2013. Consolidation in the UK vet sector is currently the subject of an ongoing market investigation by the UK’s Competition and Markets Authority.

Dawn raid activity in Ireland on the rise

There was a significant uptick in the number of dawn raids in 2024, which is expected to continue into 2025. The CCPC carried out searches at the premises of at least two home alarm companies,

namely Phone Watch and HomeSecure, as part of an ongoing investigation into potential competition law breaches.

Additionally, the Italian Competition Authority (AGCM), assisted by the CCPC, searched Ryanair’s headquarters in Dublin as part of an ongoing abuse of dominance investigation. The investigation

was triggered following complaints by online travel agencies in Italy. The Irish High Court subsequently confirmed that the AGCM was exercising public law powers when it inspected Ryanair’s Dublin premises. Therefore, under Brussels I Recast, the Irish courts do not have jurisdiction over proceedings commenced by Ryanair following the inspection.

Finally, the European Commission, assisted by the CCPC, conducted dawn raids of businesses active in the data centre construction sector concerning possible collusion in the form of no-poach agreements. For further information, watch our Dawn Raid Webinar or contact our Dawn Raid Response Team.

CCPC launches investigations into suspected anti-competitive practices

For the first time in many years, the CCPC announced it has opened not one, but two, competition law investigations. The first investigation concerns the provision of electronic patient record software and related services. The services in scope of the investigation include electronic referrals and text messaging services by healthcare software company, Clanwilliam. The second investigation centres on the provision of port infrastructure at Dublin Port and/or the provision of port towage services at Dublin Port by Dublin Port Company. These are the first investigations the CCPC has opened since obtaining its new administrative fining powers in late 2023.

Simplified procedure is a continued success

72% of merger determinations in 2024 were cleared by the CCPC under the simplified merger notification procedure (SMNP). These clearances represent a significant increase compared to 2023 figures, up from approximately 50%. The average clearance timeframe under the SMNP remains consistent with previous years at approximately 13 working days. This trend is good news for

clients, as it means that parties can generally rely on obtaining quick clearance decisions for nonsubstantive transactions. Coupled with the increase in Phase II determinations this year (see stats

below), this trend indicates that the CCPC is becoming nimbler by shifting its enforcement priorities and resources towards more complex merger cases.

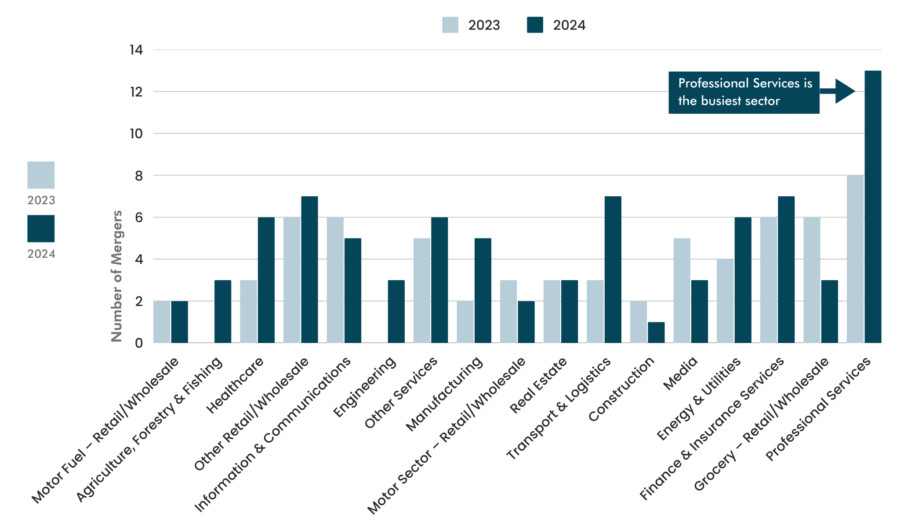

Another Busy Year for the CCPC’s Mergers Division

Number of Mergers by Sector 2023 - 2024

Looking Ahead to 2025

Introduction of mandatory FDI screening in Ireland

The Screening of Third Country Transactions Act 2023 commenced on 6 January 2025. The Screening Act introduces Ireland’s first investment screening regime enabling the Minister for Enterprise, Trade and Employment to review transactions involving foreign investors for potential risks to the security or public order of the State.

The Screening Act is one of the most significant developments in Irish M&A in recent years. It applies to transactions, directly or indirectly, involving foreign investors if the Irish asset or the Irish entity being acquired relates to, or impacts on one or more critical matters. The critical matters are:

- Critical infrastructure

- Critical technologies and dual use items

- The supply of critical inputs

- Access to sensitive information, and

- Freedom/pluralism of the media.

These sectors are broadly defined. As a result, careful consideration, on a case-by-case basis, is required before a mandatory notification can be ruled out solely on the basis that the transaction does not concern one of these sectors. For further information, please see our insight on the ‘Key Features of Ireland’s First Foreign Investment Screening Regime’.

European Media Freedom Act to commence in August 2025

The Department of Media consulted with stakeholders on the implementation of the European Media Freedom Act (EMFA), which is expected to bring significant changes to the existing Irish merger control regime. The EMFA, which puts in place a new set of rules to protect media pluralism and independence in the EU, entered into force on 7 May 2024. It is due to commence on 8 August 2025.

Some of the key proposed changes to Ireland’s media merger regime include:

- Focusing the regime on media mergers that could have a significant impact on media pluralism and editorial independence by requiring that the target has substantial activity as a media business in the State, and

- Expanding the regime to apply to all media businesses which aim to “inform, entertain, and educate”. Relevant businesses include online platforms providing access to media content, including social media companies.

Share this:

Tara Kelly

Partner, Head of Competition, Antitrust & Foreign Investment

+353 86 145 5201 tarakelly@mhc.ie