Some of the UK Government’s COVID-19 supports for businesses came to an end, or started to taper off, on 30 September 2021. The UK Insolvency service published statistics yesterday[1] showing that the number of corporate insolvencies has returned to pre-pandemic levels. There is no reason to believe that the Irish position will be substantially different when supports come to an end.

What happened when COVID-19 struck?

The Governments in Ireland and the UK provided very significant supports to companies, both directly and by restricting how creditors, particularly landlords could enforce against companies.

Those supports will undoubtedly have assisted many businesses that would have been viable but for COVID-19 and will return to viability to survive. They may also have afforded some companies in difficulty a breathing space in which to restructure and hopefully emerge as viable businesses. However, it is inevitable that some businesses that were and are not viable were kept alive through the pandemic.

What is starting to happen now supports are tapering off in the UK?

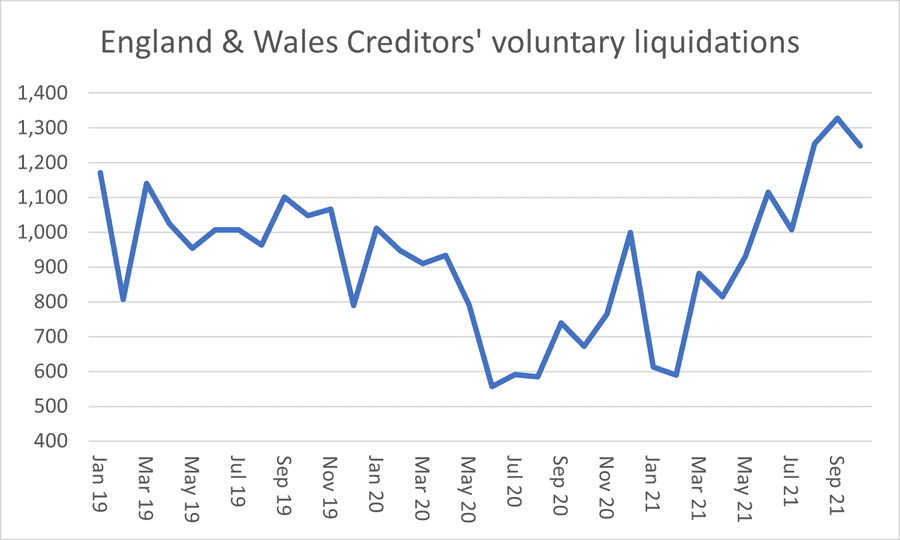

Insolvency numbers are now climbing quite rapidly in England and Wales. As shown in Figure 1 below, in October 2021 there were 1,248 Creditors’ Voluntary Liquidations (CVLs) in England and Wales. This is slightly higher than pre-pandemic levels. The total number of registered company insolvencies was similar to pre-pandemic levels, with other types of insolvency processes including compulsory liquidations, remaining lower, for now.

Figure 1 – England & Wales Creditors’ voluntary liquidations

(Figures from the Insolvency Service)

Comment

The board of a company should take all reasonable steps to find a viable future for the company. This may include seeking external advice and looking at restructuring options.

However, once the board forms the view that the company has no realistic prospect of becoming viable in a reasonable timescale, the directors have a duty to promptly take steps to cease trading and, usually, wind-up the company.

It is inevitable that creditors will eventually take steps to enforce the debts due to them if there is no visibility on payment. Therefore, taking account of businesses that can no longer survive coupled with businesses under creditor pressure, it is likely that the number of insolvencies in Ireland will follow a similar pattern to those in England and Wales, once pandemic supports and protections come to an end here. That said, we note that the Government guidance increasing restrictions yesterday to control the spread of COVID-19 is likely to lead to some of those supports and protections being further extended.

The directors of a hopelessly insolvent company expose themselves to personal risks for keeping it limping along for too long, once its ultimate failure is inevitable.

For more information, contact a member of our Restructuring & Insolvency team.

The content of this article is provided for information purposes only and does not constitute legal or other advice.

[1] 16 November 2021.